Many manufacturers across many industries are faced with an unprecedented global shortage of tech parts such as semiconductors and sensors. The Covid-19 pandemic, the higher demand than supply and the more recent political sanctions have all contributed to these shortages that impacted among others the automobile industry, game console manufacturers and the almighty – seemingly unstoppable – smartphone manufacturers. What are the implications of these global chip shortages?

During the Covid-19 pandemic many production line workers had to stay home due to lockdowns and were unavailable sometimes for several months. By the time lockdowns were lifted, the rising demand for consumer and business electronics disrupted the supply chain. Up until recently, the numbers of returning employees was limited due to social distancing restrictions that did not allow production lines to work at full capacity.

Before the events took place in Ukraine, the US Commerce Department had published a semiconductor supply chain report that projected the worldwide chip shortage to last until the end of 2022, and possibly even extend into 2023.

More recently, the beginning of the geopolitical conflict between Russia and Ukraine seems likely to add to the chip shortage woes. Palladium and neon are two key resources for the production of semiconductors. According to a Moody’s Analytics estimate, Russia supplies approximately 40 per cent of the world’s supply of palladium and Ukraine produces about 70 per cent of the world supply of neon. Thus, these chip shortages are expected to worsen if the conflict drags on for a long period of time.

Palladium Prices – source: macrotrends.net

According to the U.S. department of Commerce, on Monday March 21st, security officials from both political parties urged Congress to fast-track a legislation for “revitalizing domestic semiconductor manufacturing, boosting domestic manufacturing, and helping America economically outcompete China and the rest of the world in the 21st century”.

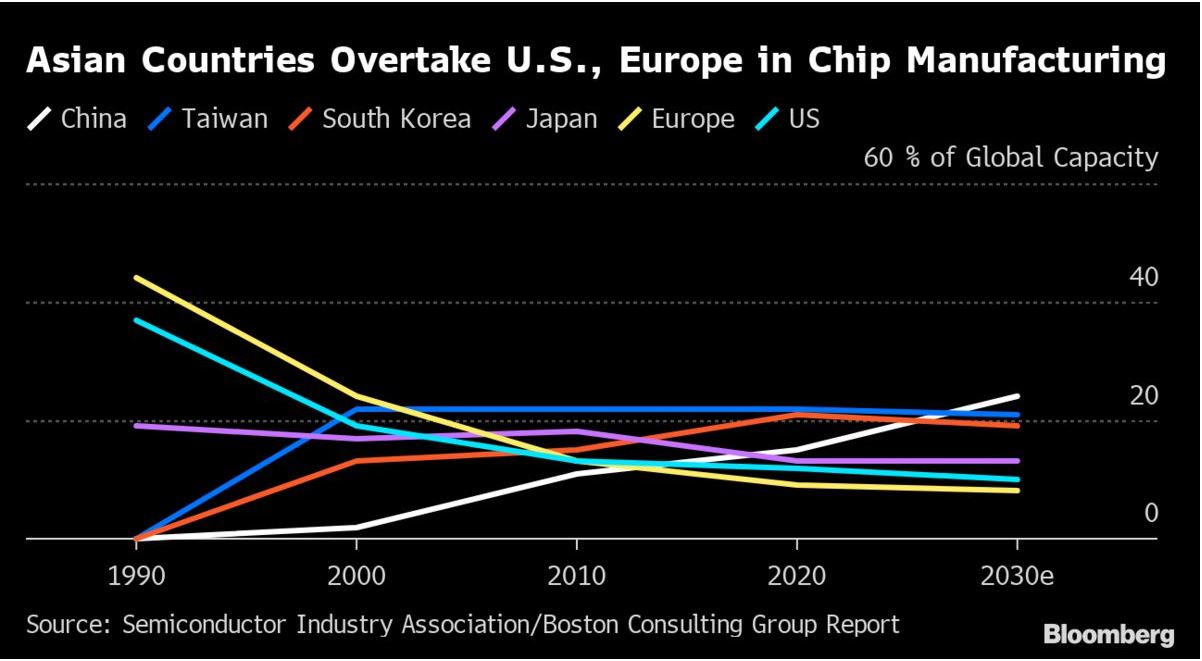

The EU is prioritizing similar policies with the European Chips Act. If this act is adopted, there will be a funding of €43 billion in public and private investments to grow the EU’s semiconductor global market share to 20 percent by 2030.

Predictions of when the shortages will come to an end vary, with most suggesting challenges will persist until at least late this year. Over the last three decades, companies took advantage of reliable, low-cost transportation and a favorable trading environment with low-cost labor in Asia to deliver cheaper products. This last three decades environment of far-reaching global supply chains is probably over. There will still be trade growth between nations, however, the focus currently seems to be towards self-sufficiency in all the goods and materials consumed by modern economies.

Sources

pinterest.com, fierceelectronics.com, forbes.com, community.fs.com, petapixel.com, business-standard.com, macrotrends.net, commerce.gov, rideapart.com, bloombergquint.com, hbr.org.

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.