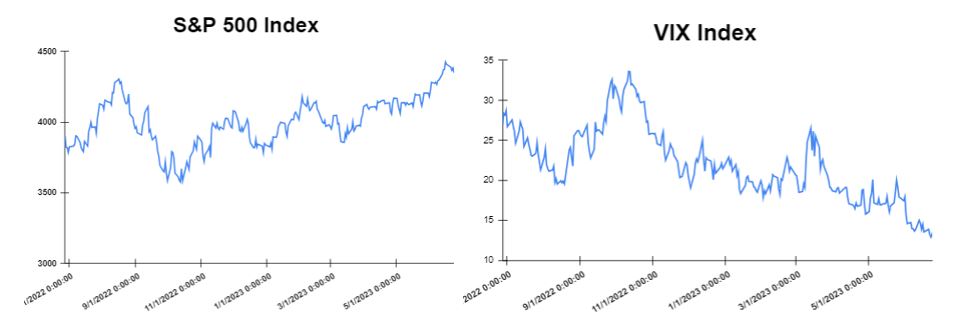

Global markets finished the week lower

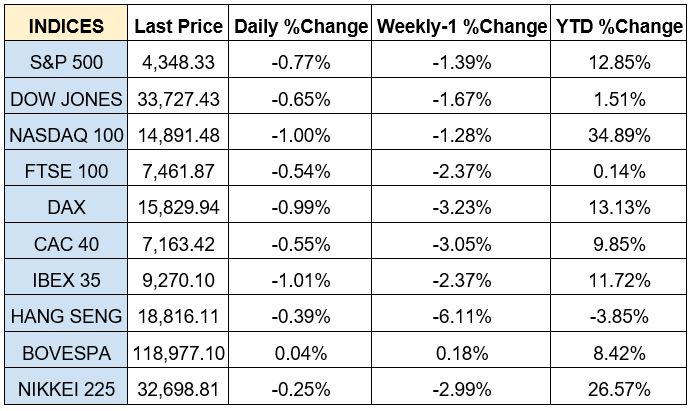

The global markets started the week lower, after a strong gain last week. On Tuesday, the Producer prices in Germany rose by 1% on an annual basis in May, making this “the smallest increase since January 2021. Month on month, the reading declined by 1.4%. Also, the Housing starts in tge US, which is a leading indicator of economic health, increased in May with 1.63 million new homes starting construction, while the building permits were 1.49 million in May, up from 1.42 million in April. On Wednesday, the European markets were moderately lower after the UK’ Consumer Price Index increased more than expected, by 8.7% year over year and by 0.7% on a monthly basis in May. Furthermore, Federal Reserve Chair Jerome Powell continued to insist that further rate hikes likely lie ahead. On Thursday, the Bank of England surprised markets by increasing its key rate by the more-than-expected 50 basis points and bringing it to 5%. Meanwhile, the Fed Chair Powell hinted at two more rate increases this year, while the US initial jobless claims were 264,000, the same as the prior week and slightly above expectations. On Friday the Europe markets moved lower after the disappointing results in the private sector activity across the continent. Specifically, the HCOB Flash Eurozone PMI Composite Output Index, which measures the services and the manufacturing business activity, stood at 50.3 in June, representing a decrease of 2.5 index points compared to the previous month and landing at a five-month low. Also, on the same day, the US PMI index, reached 53.0 in June, down from 54.3 registered a month prior, raising concerns about the economic stability in the country. Finally, the global stock markets ended the week lower, after a week full of important economic data and financial updates. The Dow Jones closed with a loss of 0.64% at the closing bell on Friday. The S&P declined by 0.76%. Furthermore, the DAX decreased by 0.99% and the CAC 40 fell by 0.55%. The FTSE 100 declined by 0.54%.

In addition, investors are looking forward to the Europe inflation (CPI) data expecting a decrease to 5.6% from 6.1%.

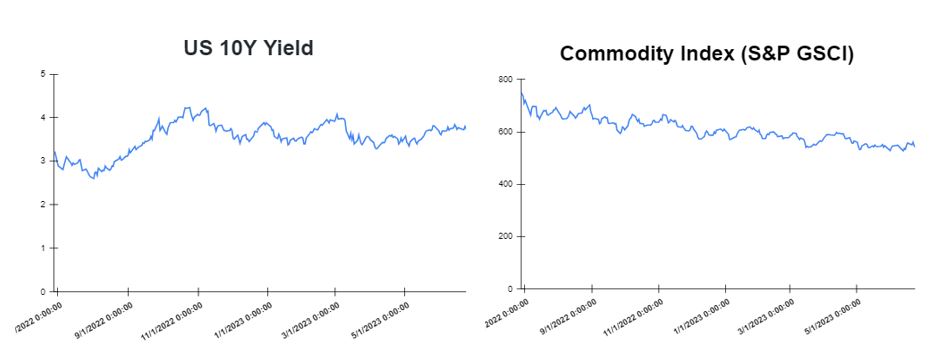

Treasury yields declined towards the end of the week

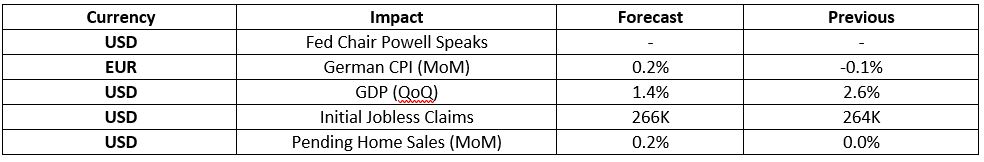

Interest rates started the week lower with the 10-year Treasury yields moving below 3.75%. On Thursday, the yields climbed higher after Powell noted that two more rate hikes in 2023 are likely. However, yields closed the week lower on Friday as investors digested remarks from FED officials about the outlook for interest rates and the latest economic data. Specifically, on Friday, the yield on the 2-year Treasury decreased to 4.750%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.735%, declining by about 6 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.82%. The spread between the US 2’s and 10’s advanced to -101.5bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) advanced to – 137.9 bps. In addition, investors are looking forward to the GDP data which is expected to decrease to 1.4% from 2.6%.

Volatile week for USD

The US Dollar at the start of the week was higher as investors were focused on Federal Reserve Chairman Jerome Powell’s testimony before Congress. In the middle of the week the US Dollar declined as US Treasury yields declined. However, on Friday, the US dollar finished higher after Fed Powell’s comments about more rate hikes. The EURUSD decreased to 1.090, while the GBPUSD declined to 1.27. Additionally, the USDJPY increased to 144.00 Yen on Friday to monthly highs.

Oil and Gold traded opposite towards the end of the week

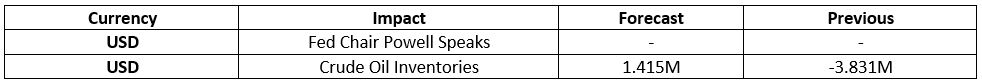

Gold started the week lower due to the People’s Bank of China (PBoC) announcement about cutting its interest rates by ten basis points and loosening its monetary policy. However, Gold traded higher at the end of the week after Federal Reserve Bank of Atlanta President Raphael Bostic shared that he would not be supporting further interest rate increases in 2023. On the other hand, prices of Oil moved higher at the start of the week after the People’s Bank of China cut its main interest rates by 10 basis points. However, at the end of the week oil moved lower, after concerns about the commodity’s demand. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show an increase of 5.246M.

Stock indices performance

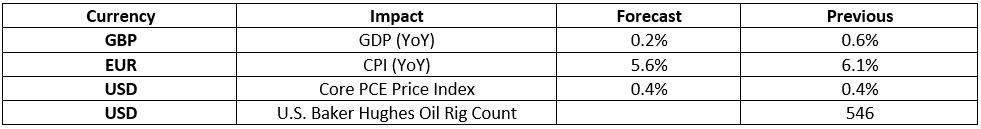

Key weekly events:

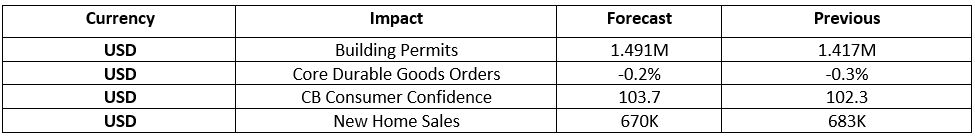

Tuesday – 27 June 2023

Wednesday – 28 May 2023

Thursday – 29 June 2023

Friday – 30 June 2023

Sources:

https://www.tradingview.com/

https://breakingthenews.net/Home

https://www.investing.com/

https://www.fxstreet.com/news

https://www.cnbc.com/world/