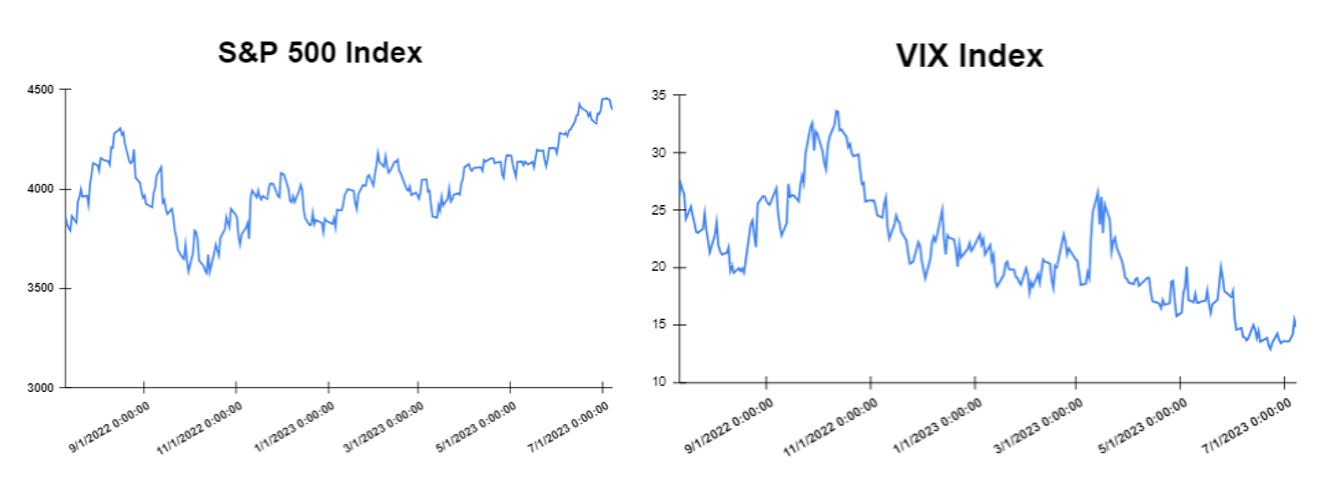

Global markets finished the week mixed

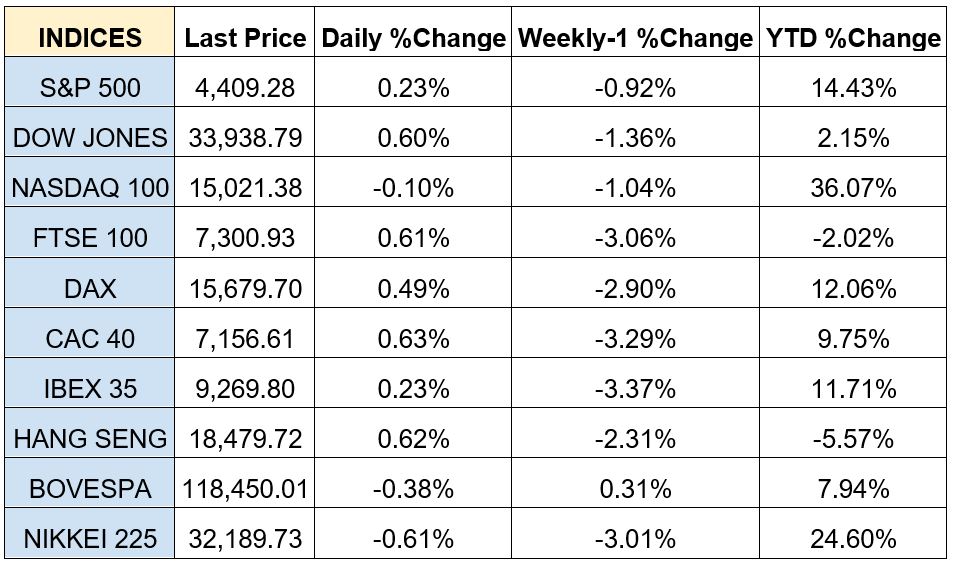

The global markets started the week mixed after the big gains on Friday’s session. The US markets closed early on Monday ahead of the 4th of July holiday. Also, on the same day, the ISM’s manufacturing purchasing managers’ index for June came in slightly worse than expected in the US, signalling that economic activity was declining. On Wednesday, the European markets closed mostly lower as producer prices (PMI) in the Eurozone decreased by 1.9% in May compared to the month before. Furthermore, the Fed officials at their June meeting, noted that a decline in the country’s inflation is slower than expected and that additional hikes in interest rates will be appropriate. On Thursday, United States private payrolls soared by 497,000 in June, well above forecasts with a result of potential further raises by the Federal Reserve’s in interest rates. Following the above news, the US market closed lower on Thursday. On Friday the Global markets closed with gains after the release of the latest United States nonfarm employment data, which showed that employment grew less than expected in June. Specifically, the June employment report increased by 209,000 and the unemployment rate stood at 3.6%, down by 0.1 percentage points from the previous month. Moreover, on the same day, the annual rate of house price growth in the United Kingdom came in at negative 2.6% in June. The Dow Jones closed with a loss of 0.55% at the closing bell on Friday. The S&P fell by 0.28%. Furthermore, the DAX increased by 0.48% and the CAC 40 jumped by 0.42%. The FTSE 100 decreased by 0.32%.

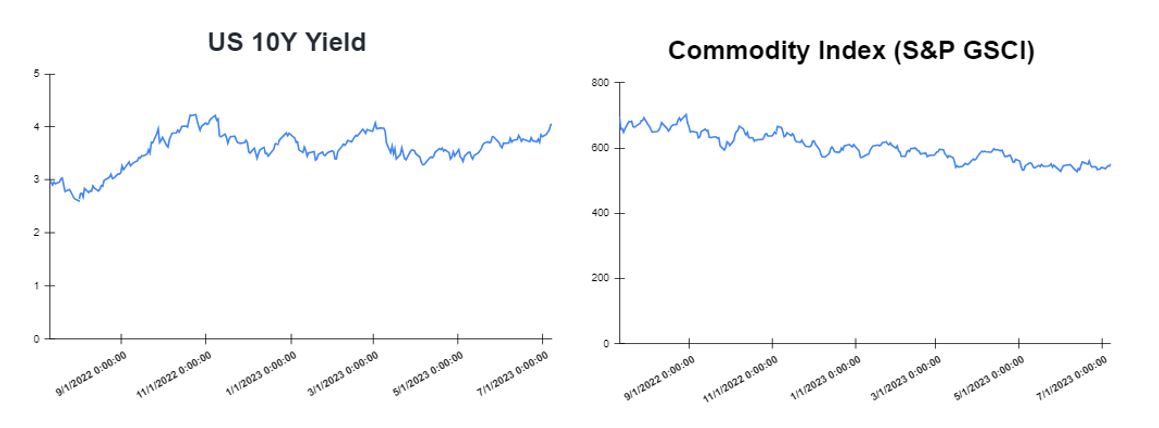

Treasury yields were mixed towards the end of the week

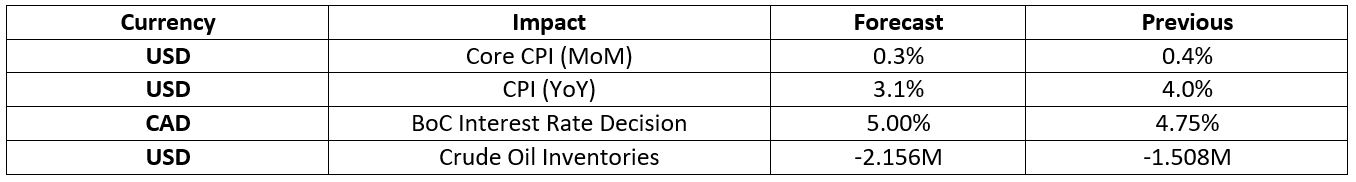

Yields were higher in the middle of the week as investors absorbed the release of the Federal Reserve’s latest meeting minutes. However, yields moved up on Thursday after reaching a level not seen in 16 years as investors absorbed strong jobs data that could mean further tightening from the Federal Reserve. ADP’s employment report showed private sector jobs jumped by 497,000 in June, far above the 220,000 Dow Jones consensus estimate. It was also greater than the 267,000 gain in May. On Friday, yields closed the week mixed as the slightly weaker-than-expected increase in June payrolls failed to dissuade traders from betting on more rate hikes. Specifically, on Friday, the yield on the 2-year Treasury decreased to 4.937%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 4.062%, growing by about 2 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 4.03%. The spread between the US 2’s and 10’s declined to -87.5bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) declined to – 133.5 bps. In addition, investors are looking forward to US inflation data report on Wednesday, 12 of July, in which a decrease of 0.9% is expected.

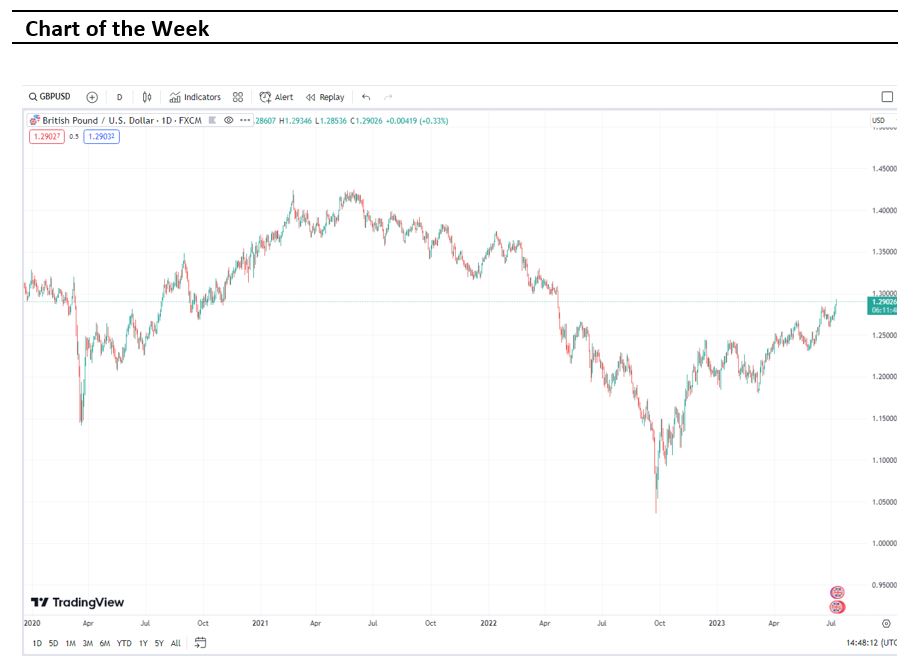

Volatile week for USD

The US Dollar at the start of the week was lower following the release of the ISM Manufacturing PMI, which came in below expectations. In the middle of the week the US Dollar advanced as US yields rose, supporting the US Dollar. The DXY rose for the third day. However, on Friday, the US dollar finished lower as the June employment report showed a slowdown in nonfarm employment growth, seemingly leading investors to believe that the inflation picture could improve and the Federal Reserve will not have to raise interest rates aggressively anymore. The EURUSD increased to 1.095, while the GBPUSD increased to 1.2833. Additionally, the USDJPY decreased to 142.24 Yen on Friday.

Oil and Gold traded higher towards the end of the week

Gold started the week higher following the release of weaker-than-expected US economic data. However, Gold traded higher at the end of the week following a softer-than-expected U.S. jobs report for June suggesting some tempering in the Fed’s hawkishness when the central bank’s policy-makers sit for their next rate review in three weeks. On the other hand, oil prices decreased on Monday after two data reports pointed to a continued downturn in the United States manufacturing sector. However, oil finished at the end of the week with strong gains, after the report on the United States oil rigs counts showed a weekly decrease of 5 rigs. Meanwhile, Russia reiterated its intention to reduce its output by 500,000 barrels per day (bpd) in August by delivering fewer exports. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show a decrease of 0.648M.

Stock indices performance

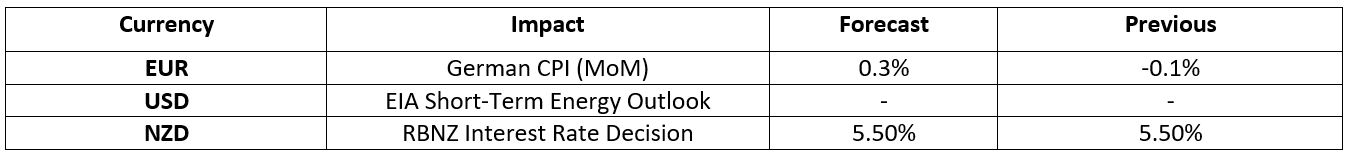

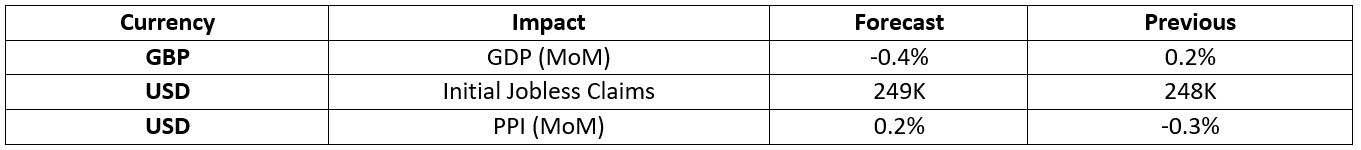

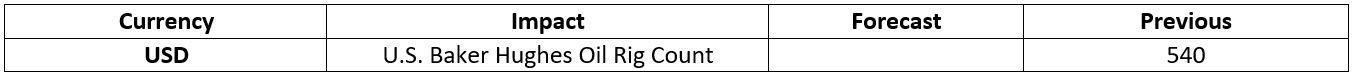

Key weekly events:

Tuesday – 11 July 2023

Wednesday – 12 July 2023

Thursday – 13 July 2023

Friday – 14 July 2023

Sources:

https://www.tradingview.com/

https://breakingthenews.net/Home

https://www.investing.com/

https://www.fxstreet.com/news

https://www.cnbc.com/world/