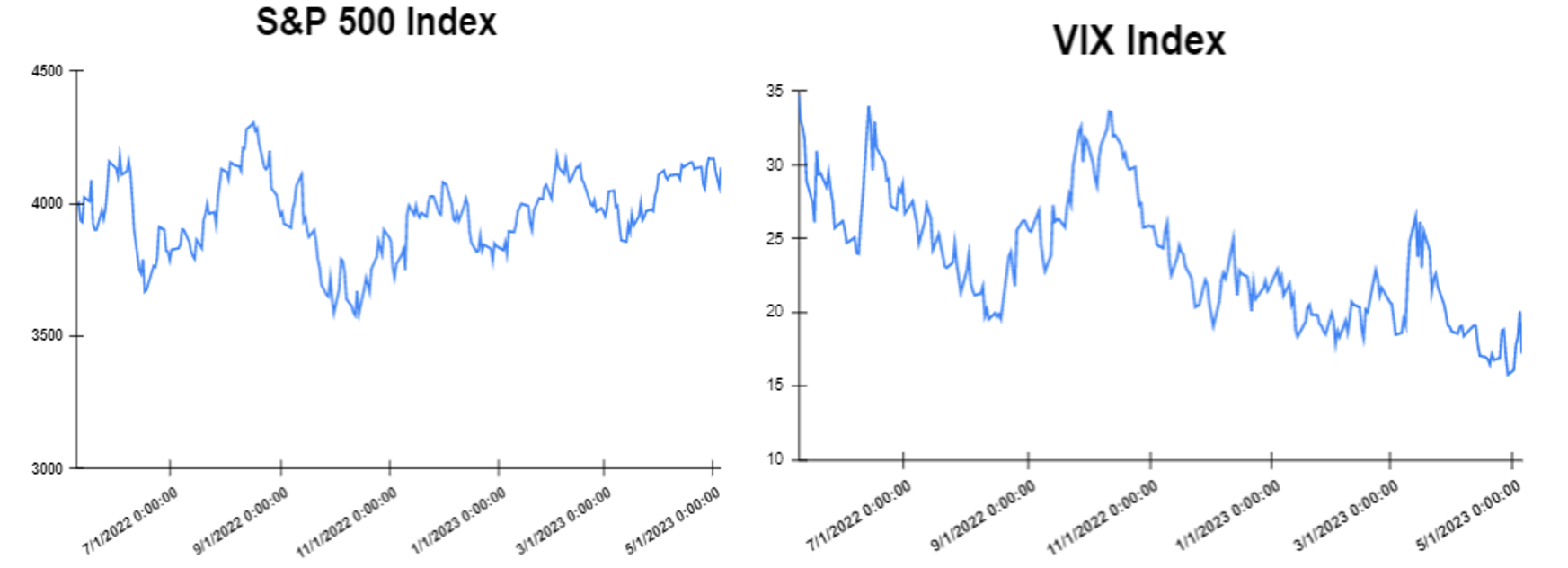

Global markets finished the week higher

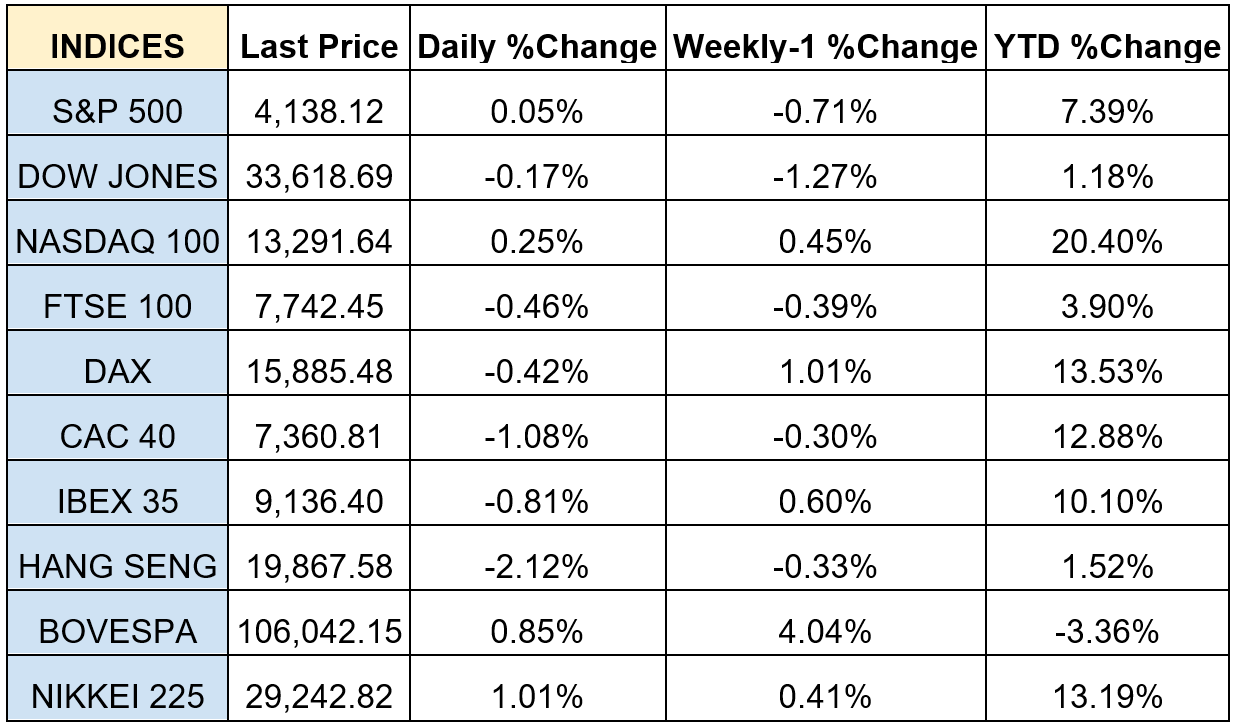

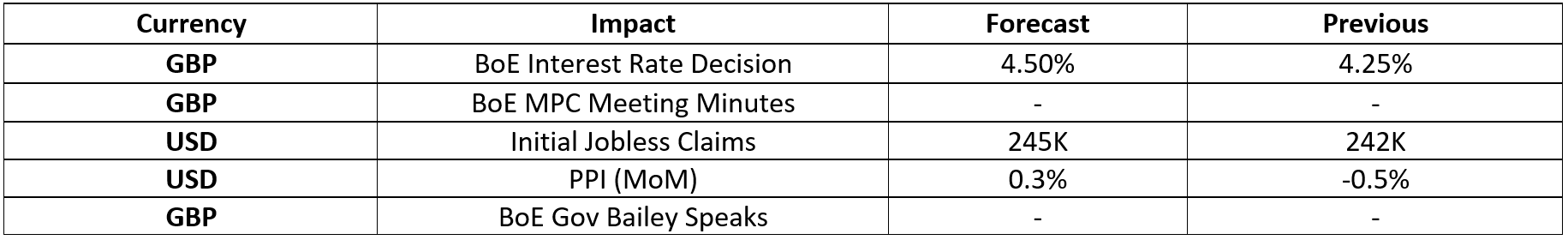

The US market started the week lower after the United States Manufacturing Purchasing Manager’s Index (PMI) stood at 50.2 in April, decreasing by 0.2 index points. Inflation in the Eurozone increased slightly on a yearly basis in April, Eurostat said in a preliminary report on Tuesday. The Consumer Price Index (CPI) grew by 7% year-on-year in April, compared to a 6.9% annual inflation recorded in March, somewhat higher than the forecast. Moreover, on Wednesday, the Federal Reserve of the United States announced a raise in the key interest rate by another 25 basis points and showed uncertainty on whether there will be new hikes in the near future and how much they will be. Specifically, the stock markets on that day closed lower as Chair Powell said that there won’t be any rate cuts if inflation remains high. On Thursday, the European Central Bank (ECB) announced its decision to hike its key interest rate by another 25 basis points as the Governing Council determined that inflation remained too high despite easing somewhat recently. However, on Friday the global market closed with gains after total nonfarm payroll employment in the United States grew by 253,000 in April more than expected, which showed that the labor market remains in healthy shape. Dow Jones traded higher at the closing bell by 1.65% on Friday. The S&P went up by 1.85%. Furthermore, the DAX gained 1.42%, CAC 40 rose by 1.31% and the FTSE 100 advanced by 0.98%. In addition, investors are looking forward to the Bank of England Interest Rate Decision expecting an increase to 4.50% from 4.25%.

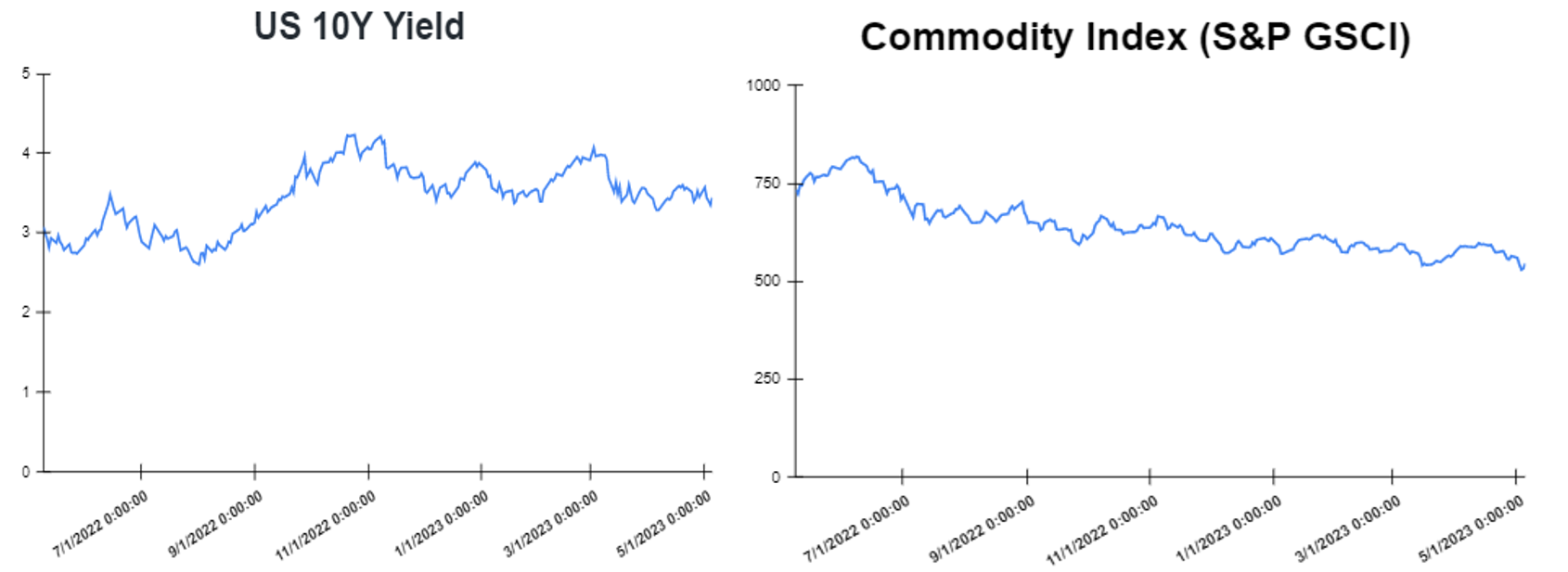

Treasury yields advanced towards the end of the week

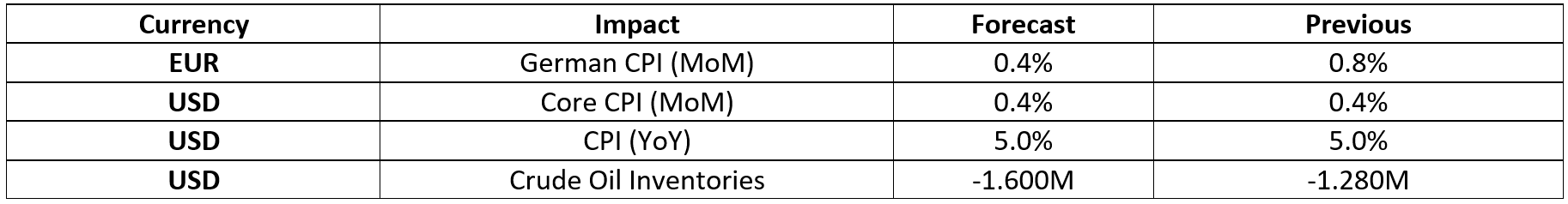

Yields started the week lower as investors sought safe-haven assets and as the Fed softened it’s language about rates hikes. However, yields increased on Friday after the release of nonfarm payrolls in April with the U.S. adding 253,000 new jobs, 73,000 more than expected. Specifically, on Friday, the yield on the 2-year Treasury increased to 3.914%. Short-term rates are more sensitive to Fed rate hikes. The 10-year Treasury yield, hit 3.439%, up by about 9 basis points. The 30-year Treasury yield, which is key for mortgage rates, hit 3.7620%. The spread between the US 2’s and 10’s declined to -47.5bps, while the spread between the US 10-Yr Treasury and the German 10-Yr bond (“Bund”) advanced to – 118.4bps. In addition, investors are looking forward to US CPI (YoY) on Wednesday which are expected to stay still at 5%.

Volatile week for USD

The US Dollar was under a selling pressure at the start of the week following the Fed’s rate decision and Chairman Powell’s comments on the policy outlook. However, after the ECB raised its key interest rates by 25 basis points, the Euro lost ground against the US dollar, with EURUSD dropping below 1.1000. On Friday, the announcements of Nonfarm Payrolls and Unemployment Rate, which ticked down to 3.4%, initially helped the US Dollar to get some demand, but finally it erased its recovery gains. The EURUSD climbed to 1.1026, while the GBPUSD increased to 1.2641. Additionally, the USDJPY raised to 134.79 yen on Friday.

Oil and Gold traded opposite towards the end of the week

Gold started the week higher as the banking sector uncertainties persist. Gold traded lower at the end of the week after a report by the United States Bureau of Labor Statistics revealed that nonfarm employment in the country rose by 253,000 in April, going above analysts’ projections and showing that the labor market is still able to withstand tight monetary conditions. Prices of Oil moved lower at the start of the week, after manufacturing data from China over the weekend fell short of expectations and reignited worries about the global economic recovery. China’s Manufacturing Purchasing Manager’s Index (PMI) stood at 49.2% in April, falling by 2.7 percentage points from the previous month. However, at the end of the week oil moved higher, after Russia promised to continue cutting theoil output, with a target of 500,000 barrels per day. Meanwhile, the Crude Oil Inventories report will be released on Wednesday which is expected to show a decrease of 0.320M.

Stock indices performance

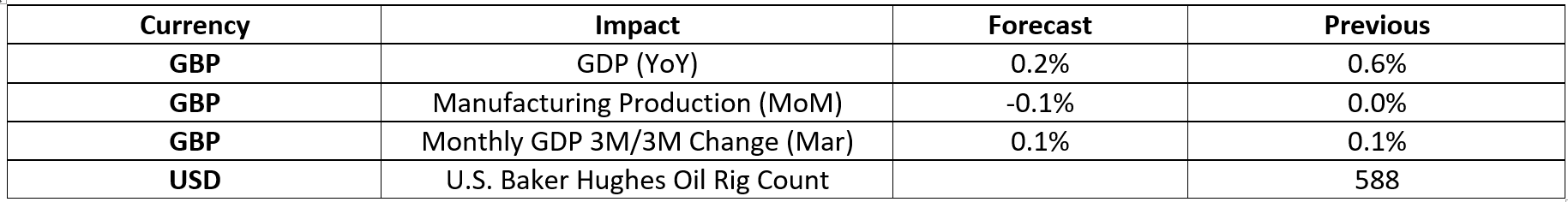

Key weekly events:

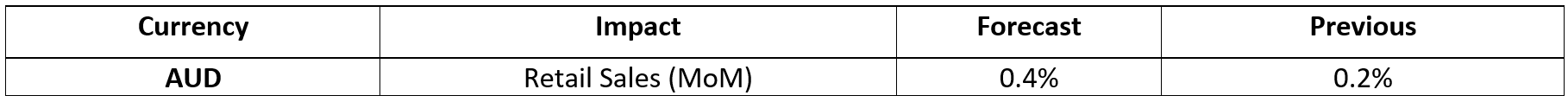

Monday – 08 May 2023

Tuesday – 09 May 2023

Wednesday – 10 May 2023

Thursday – 11 May 2023

Friday – 12 May 2023

Sources: