The times we are going through are very challenging for all investors. Everyone is seeking to build solid investment portfolios by employing risk mitigation strategies to navigate through the tough, volatile and turbulent economic environment. One such risk-mitigating method that investors may choose to employ, is the long-short strategy. Many funds today employ this strategy not only to amplify their returns but also to achieve uncorrelated performance in any market condition.

The long-short strategy involves the simultaneous purchase of assets (“long”) that are expected to rise in value and at the same time the short-selling of assets (“short”) that are expected to drop in value or not perform as well – on a relative basis compared with the long position. This practice can be employed over any investment time horizon. With both long and short positions, investors can potentially benefit both from a bull market as well as a bear market. The choice of what to long or short can be taken within the same sector, or long and short positions can be a combination of inversely related sectors.

A real-world simplified example of using this strategy in the same sector – in this case the tech-industry- may be taking a long position in Nvidia and offsetting that by taking a short position in Intel. If an investor bought 1000 shares of Nvidia at $250 each, the short side of such a trade would involve short selling 5000 shares of Intel at $50 each, if the investor wanted to keep both sides equal in dollar value.

The ideal scenario would be Nvidia appreciating and Intel depreciating in value. If hypothetically the price of Nvidia increased to $270 and Intel dropped to $49, the overall profit would be $25,000. Even if Intel appreciated to $52 while Nvidia also appreciated to $270, the overall profit would still be $10,000.

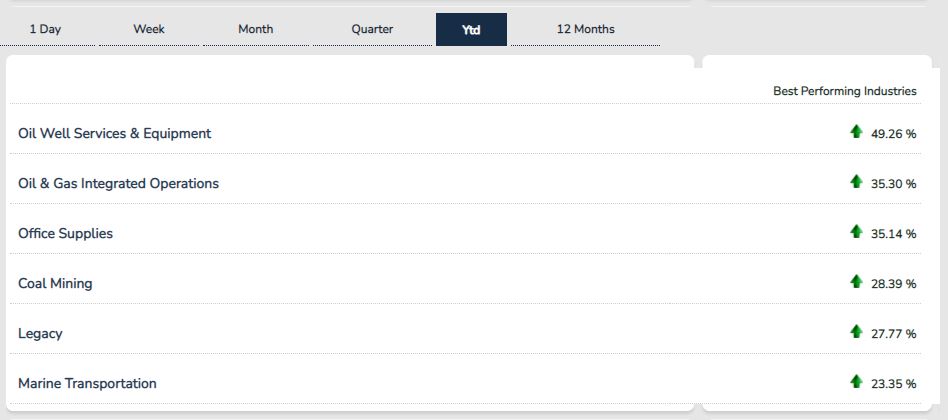

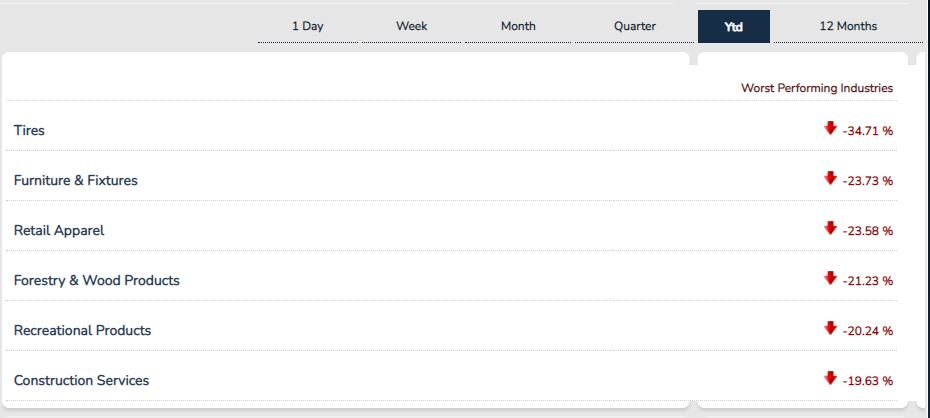

Long/short investment in different sectors, which is a more common form of this strategy, can be done when the shares in a single sector tend to move higher or lower in unison and investors try to identify overperforming and underperforming sectors in a certain macroeconomic situation (Cyclical Vs. Non-Cyclical Sectors). Another simplified example of long/short investment in different sectors as per the tables below would be going long in Utilities-Energy assets such as Oil Well Equipment and shorting the Construction sector assets such as Construction Services.

Overperforming

Underperforming

Images source – csimarket.com

A long-short strategy has both pros and cons to consider. Among the pros one should include that balancing among long and short positions can prove to be a good way to mitigate risk and gain from an increase in a down-market, but keep in mind that no strategy can eliminate all risk. Among the cons to consider is that shorting – especially shares – is more costly due to fees involved that can affect bottom line profits. It is up to the individual investor to research and choose the best long-short strategy they think would work best for them.

Sources

smartasset.com, morganstanley.com, wallstreetprep.com, investopedia.com, thebalance.com, guggenheiminvestments.com, blackrock.com, vanguard.com, sec.gov.

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.