Since World War II every yield curve inversion was followed by a recession in the following 6-18 months, and recessions are naturally correlated with decreased stock market returns. When the return of the 10-Year note is lower than the 2-Year note, that points to a negative outlook in investor confidence and a reluctance from them to commit their money in a risk-on scenario.

The US Treasury issues debt in maturities of 1, 2, 3, 6 and 12 months (T-bills) – and 2, 3, 5, 7, 10 years (T-notes) — and 20, and 30 years (T-bonds). These are issued bonds just like any other. For example, if you bought $1,000 of the 10-year bond with interest rate at 2%, then you pay $1,000 today, receive $20 every year at the end of years 1-9, and you receive $1,020 (representing $20 interest + your original $1,000) at the end of year 10.

The Federal Funds rate (Fed rate) is the target rate set by the US Federal Reserve and it is the interest rate that banks use to lend/borrow from the Federal Reserve overnight. Since the fed funds rate is the rate at which you can lend cash to the US Government overnight, this rate serves as the foundation of the yield curve. It is the same as a US Treasury bond with a 1-day maturity. When the Federal Reserve proceeds to change this rate, all other rates adjust accordingly as well.

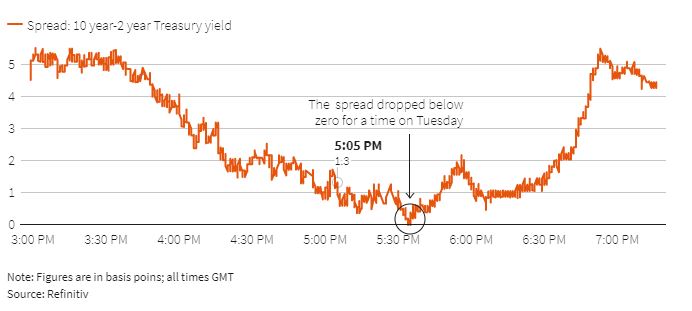

On Tuesday March 29, Bloomberg data showed the 10-Year US Treasury note yield briefly crossing below the 2-Year US treasury note yield. The last time this type of inversion happened was in September 2019. Market participants who closely watch the yields are concerned that the economy maybe headed into a recession.

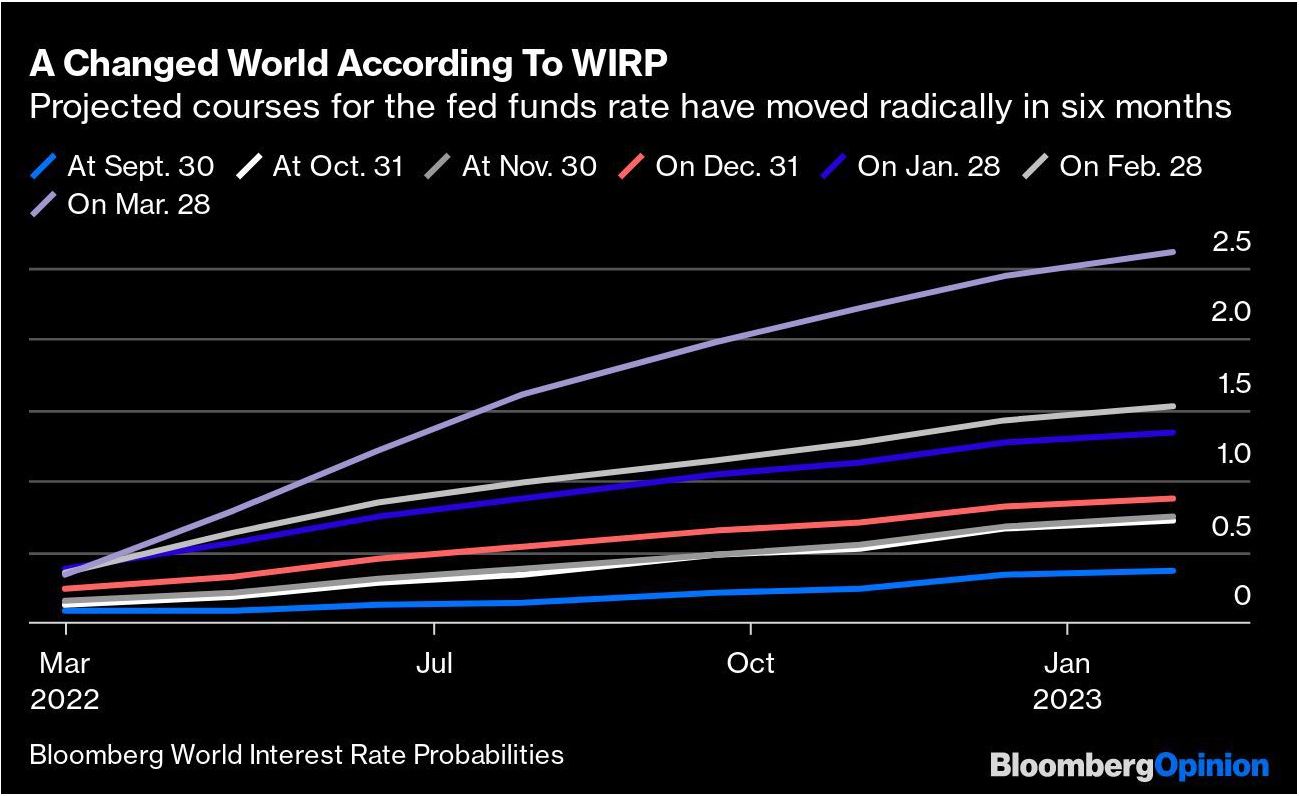

While the inversion around September 2019 was followed by a sharp market drop in 2020, nobody could foresee the closure of businesses and economic downturn that Covid-19 brought about. The concern this time is different. There is a sense by some analysts that the Federal Reserve might hinder further economic growth if it aggressively seeks to hike rates in order to fight increased inflationary tendencies. After all, prices are rising at their fastest pace in 40 years. The latest CPI figures confirm these tendencies.

On the other hand, there is another group of economic analysts that argue that the inversion is different this time. One argument to support this case is that there is increased and unprecedented intervention by global governments into bond markets. Fed intervention may have distorted by the massive bond purchases that may be holding down longer dated yields compared to the shorter dated ones. It is also sometimes argued that 2-year/10-year yields are not the most useful ones to watch, and that instead one should focus on shorter duration yields, such as the 3-month treasuries.

Yield curves are 90 percent of the time ‘normal’ with longer-term rates exceeding short-term rates. On those few occasions when they are inverted, it is almost always bad news. A short-lived inversion of the yield curve may not be a clear indicator of an imminent recession and maybe it’s too early to say. However, the market is sending signals that some form of change is coming and we can only find out what it means in hindsight rather than at the present time.

Sources

currentmarketvaluation.com, edition.cnn.com, finance.yahoo.com, reuters.com, , theconversation.com, stlouisfed.org

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.