The Fed’s benchmark overnight interest rate has been near-zero levels for the past three years, now is set at just 0.25%. At the same time the U.S. consumer price inflation is already pushing higher at its fastest pace in 40 years and many economists say the Fed needs to act soon.

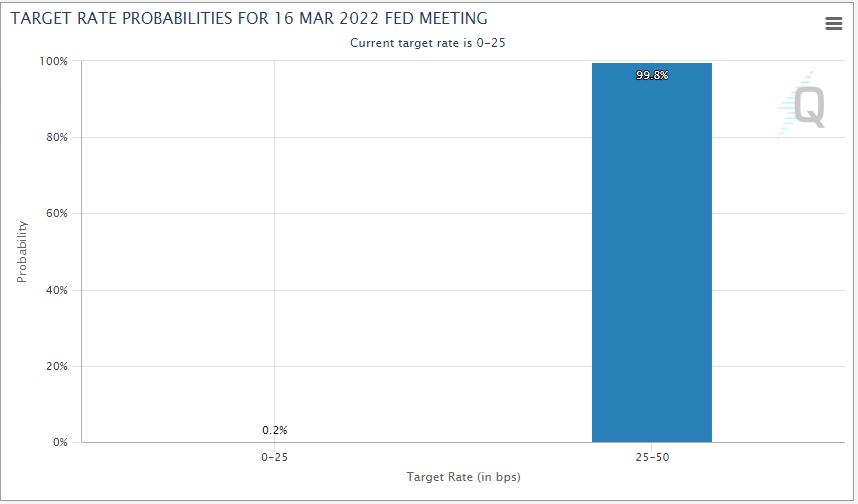

In the most recent testimony to Congress by Fed Chair Jerome Powell, on March 2nd and 3rd, the Fed communicated that is likely to raise its federal funds rate by 25 basis points (0.25%) during the March 15-16 policy meeting. A 25 basis points increase will be the first hike in three years and will take the fed funds rate to 50 basis points. However, according to CME’s Fed Watch tool, the probability of a Fed rate hike from 25 to 50 basis points stood at 99.8% as at 14th of March 2022.

Inflation – In its most recent announcement, The US Bureau of Labor Statistics reported Inflation in the US, as measured the Consumer Price Index (CPI), rose to 7.9% YoY in February, up from 7.5% in January. The US labor market unemployment is now firmly below 4% and this may keep upward pressure on pay with the Federal Reserve set to respond with higher interest rates despite uncertainty created by Russia’s attack on Ukraine.

Equities – Shares and indices seem to have priced in an interest rate increase. The same day of the testimony, the S&P ended the session up 2%. However, the S&P 500 is down about 13 percent since the start of the year, while the tech-heavy Nasdaq Composite is down even more, 18 percent, and the Dow Jones Industrials are off 10 percent or so.

Commodities – The prices of some commodities have skyrocketed recently, which could potentially complicate how fast the Fed decides to raise interest rates. Some of those increases can be tied to the Russian invasion of Ukraine. For example, oil prices shot through $100 a barrel in the early days of the conflict and have run up to $130 recently. Meanwhile, wheat futures surged from $8 a bushel to more than $12.

Borrowing – Potential rate hikes will result in costlier borrowing for individuals, households and corporations. At the same time, higher rates will put pressure on growth stocks as well as indebted corporate entities such as utilities. Technology stocks thrived during the low rates period because they could more easily invest in innovative projects.

Some analysts say that the Ukraine crisis is threatening global growth and is set to ramp up the pace of inflation also puts the Fed between a rock and a hard place. Hiking rates too aggressively and risking slowing an economy that is already expected to decelerate amid high inflation is a possible scenario. On the flip side, this scenario maybe far-reached with the unemployment rate steadily below 4%.

All eyes are now turned on the Fed and with interest rates expected to rise in 2022 the big question right now is just how high they might go and how fast.

Sources

reuters.com, fred.stlouisfed.org, cmegroup.com, bankrate.com, think.ing.com, investing.com, tradingview.com.

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.