Corn futures are exchange-traded contracts on the Chicago Board of Trade (CBOT) and are amongst the top 5 most-commonly traded commodity futures. Corn is the most widely grown crop across the United States, and corn futures contracts are the most active commodity in grains and oilseeds.

Corn’s major use is to serve as livestock and poultry feed. It also serves as a crucial ingredient in many of the foods we consume daily as humans such as corn oil for margarine, corn starch for gravy, and corn sweeteners for soft drinks, just to name a few. Non-food uses of corn among others include alcohol for ethanol fuel, absorbing agent for disposable diapers, and adhesives for paper products.

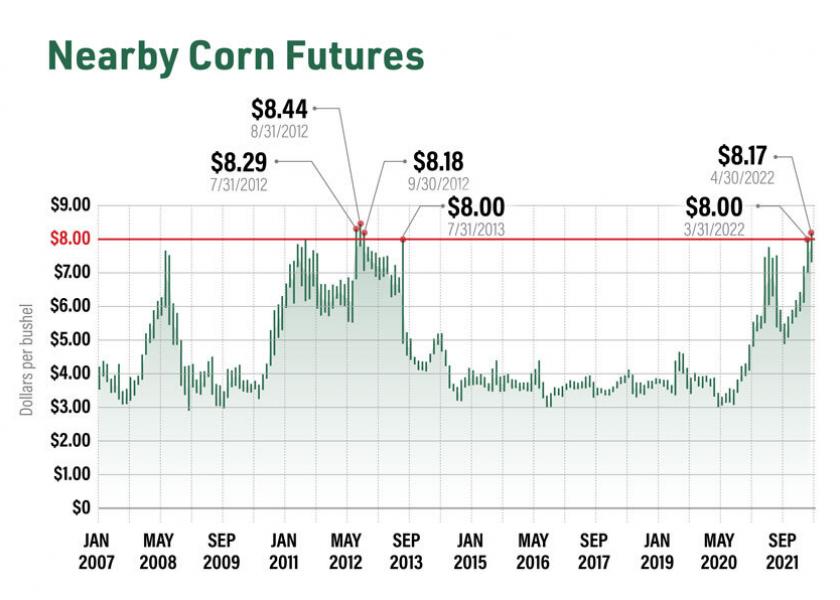

Corn futures are traded electronically on the Globex platform from 01:00 a.m. GMT to 7:20 p.m. GMT, at 5,000 bushels per contract. On March 31, May corn futures traded above $800. Since then, prices have traded close to that level which was last seen in 2013.

China is the second largest producer of Corn, yet even they seem to have problems with covering their needs. The US department of Agriculture reported in April, sales of more than 1 million metric tons of U.S. corn to Chinese buyers. The USDA daily grain sale report showed a Chinese purchase of over 1 million tons of U.S. corn, with 676,000 tons for delivery in the current 2021-22 marketing year and 408,000 tons for delivery in 2022-23. China bought millions of tons of U.S. corn last year as well, most of which it did not take possession, but left on the books. That corn stayed on the books as China ramped up purchases from Ukraine. But after the Russian invasion, China started claiming that U.S. corn.

The sale comes at the same time that a USDA report showed a smaller-than-expected U.S. corn crop this year as well as amid the war in Ukraine that has cut off Ukrainian exports.

Corn is just one of several agriculture commodities that has seen prices surging in the past few weeks, partially due to the war in Ukraine. Ukraine is a major exporter of wheat and other items, such as sunflower oil, while Russia is a key producer of wheat and many of the chemicals used in fertilizer. That is leading futures traders to bet that higher input costs and more demand for corn as a substitute food item will drive up the price.

Even prior to the war, agricultural commodities experienced upward pressure amid supply chain disruptions and high transportation costs that are contributing to inflation throughout the economy.

Another factor for the prices we see today is the drought in the western U.S. and elsewhere in the world, which has also driven prices higher. As of May 1, USDA estimated 14% of the U.S. corn crop has been planted. That compares to a five-year average of 33% planted by this time in the year. Last year, 42% was planted by May 1. This year’s planting pace is the slowest since 2013.

Another determining factor for higher corn prices is ethanol production, which consumes roughly 40% of the U.S. corn crop refined into ethanol. Ethanol processors are still looking for bushels to buy, and are bidding aggressively in the cash market, thus raising the prices.

Fundamentals: It seems lately that better forecasts for producers to close the gap in the planting delay in the US are likely playing a role to the latest correction seen on corn prices. Analysts are expecting the upcoming weekly Crop Progress reports to show the U.S. corn crop increasing but still remaining behind the 5-year average.

Technicals: Corn futures are seen breaking below the support from 770-780. If the Bulls cannot hold the ground above this pocket, we could see additional long liquidation taking prices down towards 747-753. It’s too early to say that the support has cracked. The next days or weeks could prove detrimental for the prices of corn. For now corn steadily holds near the 800-level.

Will corn futures soar even higher towards new historical highs, or will the prices remain under control and correct to lower levels in 2022?

Sources

schwab.com, agweb.com, cnbc.com, agri-pulse.com.

*Disclaimer: The information contained in this publication does not constitute investment advice and is not a personal recommendation from NaxexInvest. Nothing contained herein constitutes the solicitation of the purchase or sale of type of financial instrument. Any investment activities undertaken using this information will be at the sole risk of the relevant investor. NaxexInvest expressly disclaims all liability for the use or interpretation (whether by visitor or by others) of information contained herein. Decisions based on this information are the sole responsibility of the relevant investor. Any visitor to this page agrees to hold NaxexInvest and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information.